Recent developments have seen a notable plunge in mortgage rates, sparking renewed interest among homebuyers and investors. This article delves into the latest trends in mortgage rate movements, exploring the economic factors driving these changes and the potential impact on the housing market and consumers seeking loans.

Current Mortgage Rate Trends and Economic Drivers

As of early August 2025, the average rate for a 30-year fixed mortgage has dipped to approximately 6.57%, marking a 10-month low, down from about 6.74% just a week prior. This modest yet meaningful drop signals a shift from the relatively stagnant or slightly high rates experienced earlier in the year. The decline is partly attributed to financial market reactions and anticipation of changes in broader economic policies.

Several economic factors influence mortgage rates, notably the Federal Reserve’s approach to key interest rates and ongoing inflation trends. While the Fed held its benchmark rate steady recently, market dynamics suggest a cautious optimism for lower borrowing costs. Inflation data and employment reports remain under scrutiny, as they dictate future monetary policy moves that can directly or indirectly affect mortgage rates.

In addition to macroeconomic forces, lenders adjust rates based on borrower-specific variables such as credit scores, loan term preferences, and down payment size. Meanwhile, increasing housing inventory and moderating home price growth contribute to a more balanced market environment, which supports the potential for further rate reductions.

Implications for Homebuyers and the Housing Market

The recent mortgage rate plunge brings mixed effects for homebuyers. On one hand, even small decreases in rates can improve affordability, reducing monthly payments and making homeownership accessible to a wider audience. Adjustable-rate mortgages are also seeing declines, offering competitive initial rates for certain buyers willing to accept some risk.

However, despite these encouraging signs, rates remain above 6.5%, which still poses challenges for cost-sensitive buyers, particularly first-time purchasers. The housing market itself remains somewhat sluggish, as the combination of past high rates and rising home prices earlier in the year has dampened buyer enthusiasm.

For sellers and investors, a modest rate drop may stimulate renewed activity, but it is unlikely to trigger a rapid surge in demand without other supportive economic conditions. Many experts anticipate a gradual easing of mortgage rates through 2025, though short-term fluctuations and possible rate rebounds cannot be ruled out. As a result, consumers looking to lock in loans should carefully consider timing, weighing the benefits of current rates against potential future adjustments.

Summary and Outlook

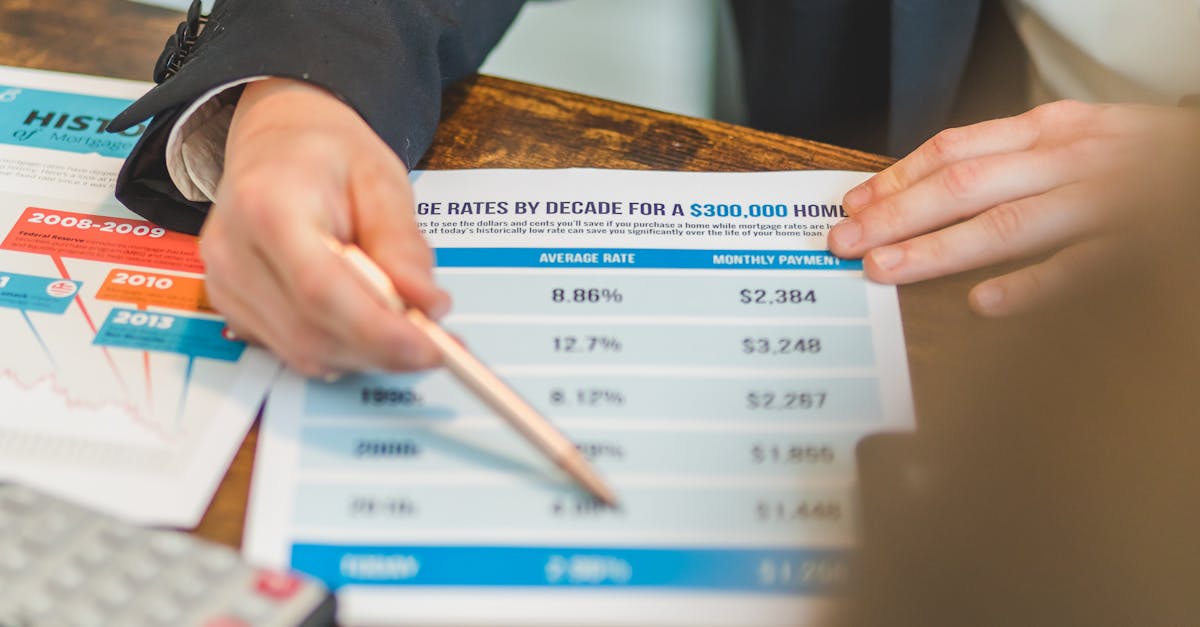

The recent plunge in mortgage rates to near 10-month lows marks a significant event in the 2025 housing and lending landscape. Supported by static Federal Reserve rates and evolving economic indicators, mortgage borrowing costs have become slightly more favorable for buyers. However, rates remain historically elevated compared to prior years, maintaining some pressure on affordability. Looking ahead, the trajectory of mortgage rates will depend heavily on inflation trends, economic growth, and central bank policies.

Homebuyers and industry participants should watch closely as these factors unfold, balancing optimism about improving borrowing conditions with caution about lingering uncertainties. In this complex environment, even small changes in mortgage rates can materially influence housing decisions, emphasizing the importance of staying informed and strategically navigating loan options.